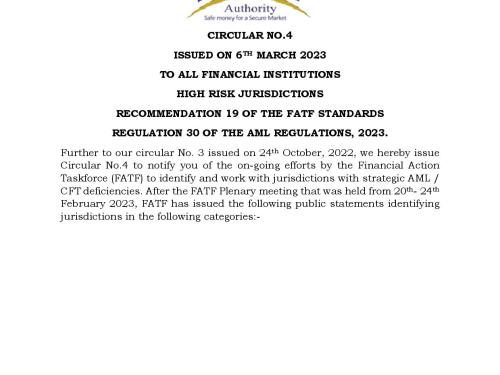

Press Releases February 20, 2023

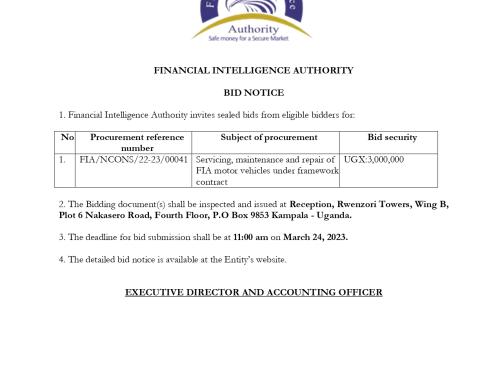

Press Releases February 20, 2023The detailed bid notice is available at the Entity’s website at https://www.fia.go.ug/bid-notices and at www.gppa.go.ug

Press Releases December 23, 2022

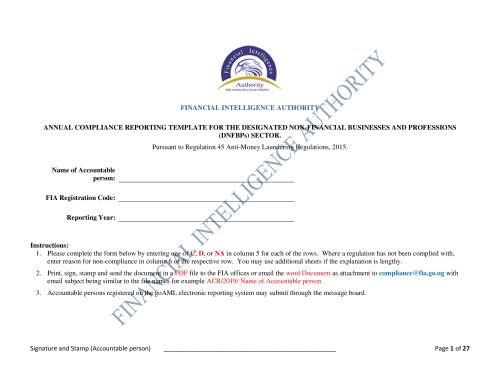

Press Releases December 23, 2022ANNUAL COMPLIANCE REPORTING TEMPLATE FOR THE DESIGNATED NON-FINANCIAL BUSINESSES AND PROFESSIONS (DNFBPs) SECTOR.

Pursuant to Regulation 45 Anti-Money Laundering Regulations, 2015.

Annual Compliance Reporting Template for DNFBPs.

Press Releases December 15, 2022

Press Releases December 15, 2022Uganda has strengthened its efforts to combat money laundering by implementing new regulations and increasing the monitoring of financial transactions. This is crucial in protecting our economy and ensuring a fair and transparent financial system. The FIA is also working to engage with other law enforcement agencies such as the Uganda Police Force to promote compliance with AML regulations. This includes providing training and guidance to gazetted officers, working with them to identify and address potential vulnerabilities.